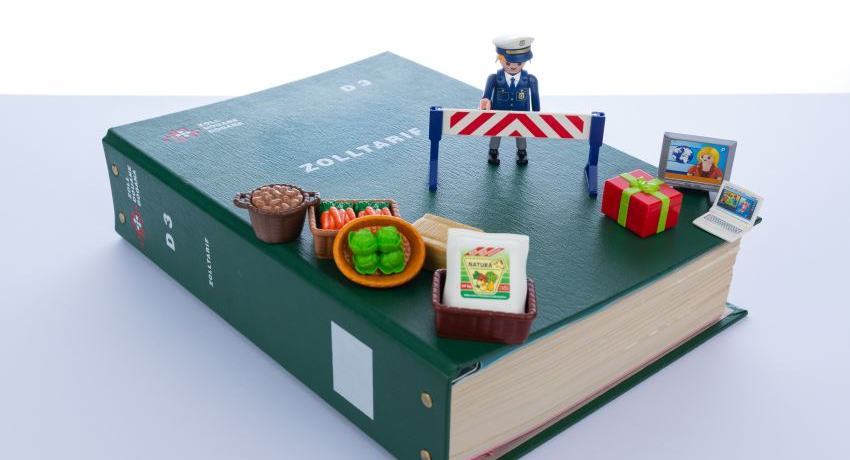

Legally minimizing customs duties and other levies

As soon as goods are transferred cross border, companies see themselves confronted various and complex questions: How much customs duties do we have to pay? May they be reduced? Is an import or export licence needed? Do we have to consider further levies, such as e.g carbon tax or the levy on volatile organic compounds (VOC)? Are there any other rules to be observed such as e.g. the UNESCO Convention on the international transfer of cultural property, or CITES (Convention on International Trade in Endangered Species of Wild Fauna and Flora)? What rules have to be followed in case food is to be imported to Swiss territory?

While answering these questions is not even easy when it comes to imports to Swiss territory (CH / FL), it gets even more difficult when trading goods internationally. Today, it is not uncommon that even companies in their start-up phase produce goods in Czechia or China which may end up with end customers in e.g. Saudi Arabia.

We support you in navigating the jungle of the provisions that may apply.

When it comes to imports to / exports from Swiss territory, you will find below a list of our – non exhaustive – services:

- Clarifying the applicable rules and regulations with the responsible authorities

- Obtaining binding tariff information from the Federal Customs Authorities

- Legally optimizing the use of Free Trade Agreements

- Support in case of customs audits by the Federal Customs Authorities

- Clavatax Steuer-Advokatur AG will support and represent you in (criminal) customs proceedings

- etc.

In case you are confronted with questions relating to foreign jurisdictions, you will find below a list of our – non exhaustive – services:

- Preliminary clarifications regarding the rules and regulations that apply locally

- We support you in finding appropriate and suitable contact persons in the jurisdictions involved

- Plausibility checks of answers received by foreign contact persons

When it comes to binding advice relating to foreign jurisidctions, we would rely on advice received from local contact persons.